Vita Collective’s Investment Committee has identified key global economic uncertainties, including China’s large-scale stimulus, tensions in the Middle East, and the upcoming U.S. elections. China’s $500 billion stimulus aims to boost sectors like real estate, but long-term effects remain uncertain due to structural challenges. Middle Eastern conflicts threaten energy stability, potentially driving up oil prices and complicating inflation control. In the U.S., a divided government may provide market stability, while a strong labor market supports consumer spending. Despite these risks, the committee remains cautiously optimistic about the resilience of the U.S. economy.

Table of Contents

- Global Tensions: China and the Middle East

- China’s Stimulus: A Short-Term Fix or a Sustainable Solution?

- Middle East: A Region of Enduring Conflict

- Inflation: A Threat on the Horizon?

- The US Elections and the Effects on the Economy

- Elections: Policy Over Politics

- Employment: The U.S. Job Market Remains Strong

- Consumer Spending and Retail Sales

- Conclusion

- Key Market Indices

Nicholas Benzor

Principal Planner and Chief Executive Officer

Benzor Capital Wealth

Global Tensions: China and the Middle East

China’s Stimulus: A Short-Term Fix or a Sustainable Solution?

China has rolled out a massive stimulus package aimed at reviving critical sectors, including real estate, car manufacturing, and consumer spending. The government’s goal is to kickstart economic growth amid fears of a deeper slowdown. Early estimates suggest that hundreds of billions of dollars have been injected into the economy, though the exact figure could be as high as $500 billion, depending on the scope of the initiatives.

But has this stimulus worked? Initial reports show some stabilization, particularly in real estate, where prices were previously plummeting. However, the long-term sustainability of this recovery is still in question. While manufacturing and consumer spending have seen short-term boosts, it remains unclear if the stimulus can address structural issues like China’s aging population, the overleveraged real estate sector, and ongoing regulatory risks. The Chinese government’s unpredictable regulatory environment, which has affected sectors like technology and education in recent years, adds another layer of uncertainty. Investors should watch for signs of whether this surge in liquidity translates into sustainable growth or simply delays in deeper economic problems.

Middle East: A Region of Enduring Conflict

Meanwhile, the Middle East, a region with 5,000 years of geopolitical conflict, continues to be a major source of uncertainty. Tensions involving key players like Israel, Iran, and Saudi Arabia not only affect the region but also reverberate through global markets. The potential for conflict here could disrupt energy supplies, further amplifying oil price volatility, with downstream effects on inflation and global economic stability.

Inflation: A Threat on the Horizon?

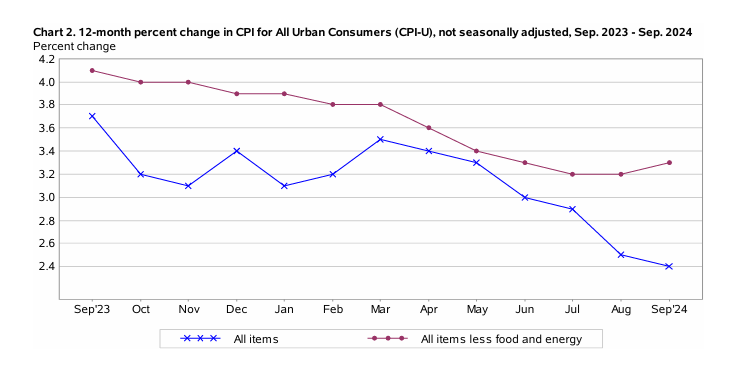

Is inflation truly under control? The Federal Reserve’s recent moves suggest that inflationary pressures in the U.S. may be easing, but the situation remains delicate. Global factors, particularly those stemming from Middle Eastern conflicts, could change this picture rapidly.

Oil and gas prices, key drivers of inflation, remain vulnerable to geopolitical risks. Both WTI Crude and Brent Crude prices could spike significantly if conflict in the Middle East escalates, leading to higher transportation and production costs across the global economy. This would place renewed pressure on central banks to hold interest rates where they are or even raise further, even as many economies are already grappling with high borrowing costs.

Arthur Bush

Founding Partner & Chief Executive Officer

Vita Financial

The US Elections and the Effects on the Economy

Elections: Policy Over Politics

As the U.S. heads into another election season, the likelihood of a split government looms large. A divided government—where different parties control the presidency and one or both chambers of Congress—historically leads to legislative gridlock. While this can sometimes slow down progress on sweeping reforms, it also provides a certain level of stability for markets. Investors can expect fewer radical policy shifts, with the focus likely to remain on issues like inflation control and fiscal responsibility.

For the markets, a split government could mean continued support for sectors that benefit from government spending, such as defense and infrastructure, while industries more reliant on legislative changes (like healthcare or technology) may see slower growth. Bonds may also become more attractive as interest rates peak and political risks are priced into the market.

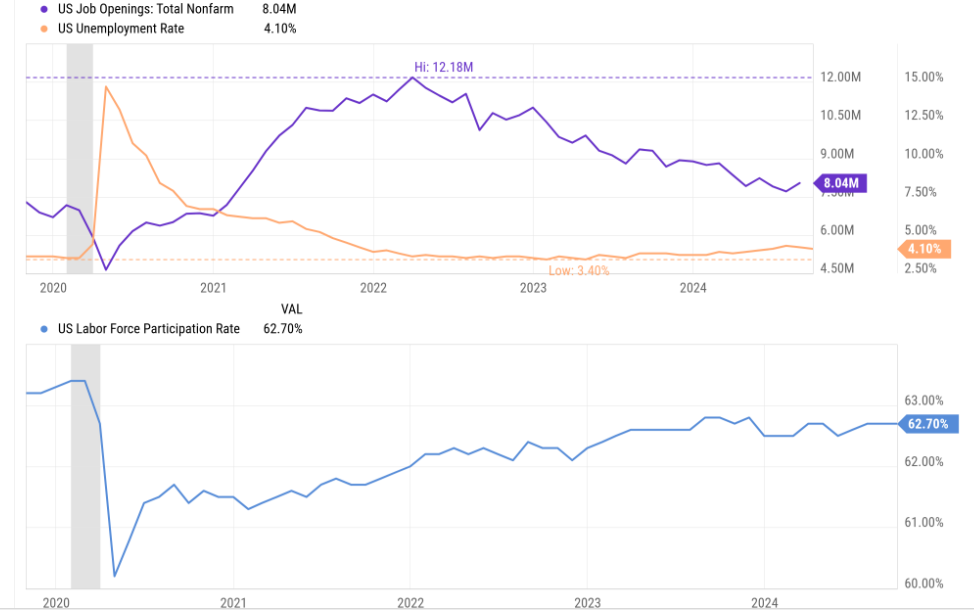

Employment: The U.S. Job Market Remains Strong

Amid the backdrop of inflation concerns and geopolitical tensions, one bright spot in the U.S. economy remains the labor market. Job numbers continue to exceed expectations, with initial jobless claims staying historically low and unemployment rates holding in the 4% range. This resilience in employment is critical to sustaining consumer spending, which has remained a cornerstone of U.S. economic growth.

With jobs stable and wages showing moderate growth, the U.S. economy is well-positioned to absorb some of the external shocks from inflation or global tensions. However, any signs of weakness in employment could signal trouble ahead, especially as the Fed continues to navigate its inflation-fighting policies. For now, though, the labor market remains a crucial buffer for the U.S. economy, providing investors with confidence as they navigate an uncertain global landscape.

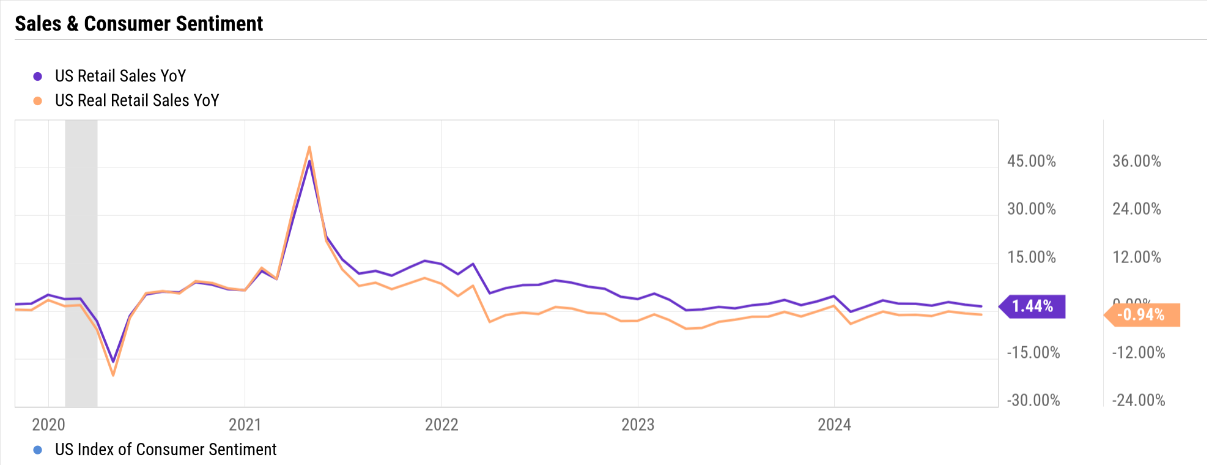

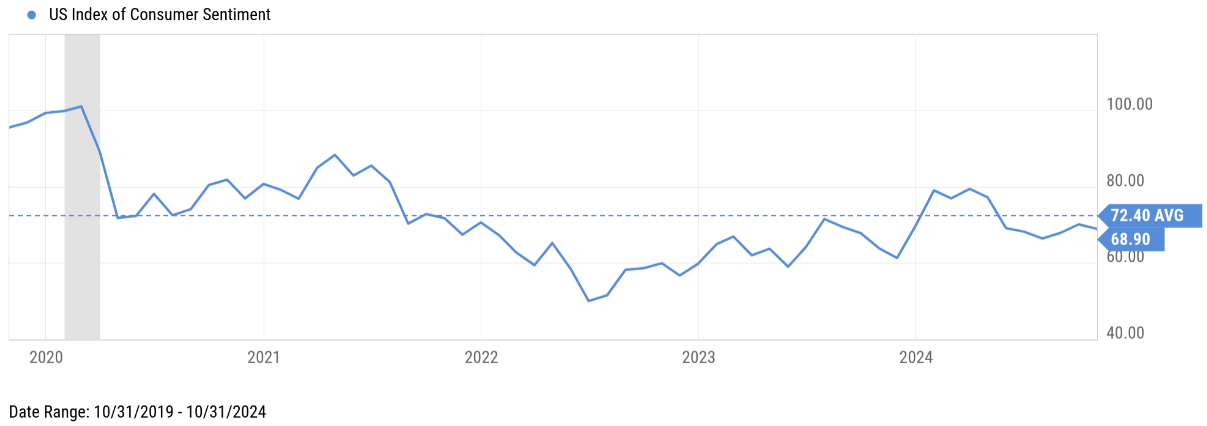

Consumer Spending and Retail Sales

Consumer spending is a critical driver of economic growth, as it fuels demand for goods and services across sectors. When employment rates are high, consumers typically feel confident in their financial stability, which encourages spending and stimulates the economy. However, if unemployment rises, consumer spending would inevitably fall, as individuals tighten budgets and prioritize essential expenses over discretionary purchases. This reduction in spending reduces demand, leading businesses to scale back production and investments, which can further contract the economy. In this cycle, reduced consumer activity directly impacts growth and has the possibility to deepen economic downturns.

Conclusion

While global tensions remain high, and concern surrounding the U.S. elections remains constant, the strength of the U.S. consumer remains resilient. Our Investment Committee continues to monitor these global and domestic risks and will update our clients and respective portfolios accordingly. We remain steadfast in our belief that the U.S. free market economy is the best positioned for long-term economic growth, and that belief will continue to be reflected in our portfolio design.

We look forward to providing you all with these monthly market commentaries, but do not hesitate to reach out to our team directly with any questions you may have. Your goals and your achievement of financial freedom remain our primary objective, and transparency along the way is what we pride ourselves on. We are here for each and every one of you all along the way.

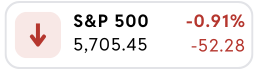

Key Market Indices

*Market Indices as of 10/31/2024

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult a financial professional for your personal situation.

Past performance does not guarantee future results. Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Graphs provided by YCharts.

Key Market Indices according to Google Finance.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker/dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Vita Financial are not affiliated. The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this email in error, please reply to the sender to inform them of this fact. We cannot accept trade orders through email. Important letters, email, or fax messages should be confirmed by calling (678) 250-5099. This email service may not be monitored every day, or after normal business hours.